Editor’s note: This article contains outdated content but has been left up for anyone searching for this information. Check the EZ Invoice Factoring blog section to find our more recent content.

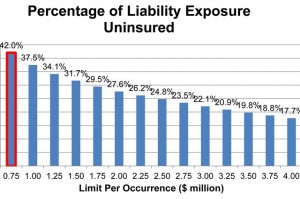

Research released by a group of trucking companies shows the federal insurance requirement for the industry is too low. The Trucking Alliance, an organization made up of seven carriers that push for safety legislation on Capitol Hill, discovered that the dollar settlements in some cases were much higher than the minimum $750,000 federal insurance requirement. According to a study of the data by the actuarial firm of Bickerstaff, Whatley, Ryan & Burkhalter, though these high payments only happened around 1% of the time, it was enough to establish an uninsured liability of 42% for the businesses. For their analysis, members of Alliance supplied data on over 8,600 accident settlements from the years 2005 to 2011. The Alliance’s study came out as the Federal Motor Carrier Safety Administration (FMCSA) finished its own study on the insurance standard, as required by the highway law Congress approved last year.