Quick funding for construction suppliers

Slowdowns in the construction industry can have a negative impact on construction suppliers’ cash flow, between customers closing up shop and taking up to three times as long to pay outstanding invoices. While offering fast-pay incentives may help bring cash in more quickly from some clients, others will likely continue paying as they have to get the most out of their own cash flow.

Unfortunately, creditors still expect to be paid in full and on time. Construction suppliers who cannot meet their day-to-day expenses run the risk of limited ability to fill orders, difficulty paying employees, and possibly even closing their doors.

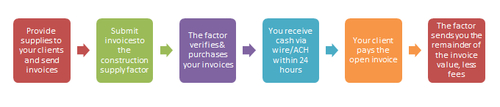

Rather than close your doors, consider construction factoring for your company. Invoice factoring turns your current receivables into a liquid asset you can use to keep your company running. The factoring process is simple:

More importantly for smaller companies, factoring for construction suppliers is better for the balance sheet than a traditional line of credit.

Benefits of Factoring for Construction Suppliers

Construction factoring offers numerous benefits for construction suppliers, including:

- Improved Cash Flow: Construction factoring provides immediate access to working capital, enabling suppliers to manage their finances more effectively.

- Increased Flexibility: Factoring allows suppliers to take on new projects and customers without worrying about cash flow constraints.

- Reduced Administrative Burden: Factoring companies handle the collection of payments, freeing up suppliers to focus on their core business.

- Enhanced Creditworthiness: By using a factoring company, suppliers can improve their creditworthiness and increase their chances of securing new contracts.

These benefits make construction factoring an attractive option for suppliers looking to maintain financial stability and grow their business.

Ready to Get Started?

Fill out the form below and one of our factoring experts will help you on your way!

Invoice Factoring

- Unlimited funding potential – your access to cash grows with your business

- Your invoices are your collateral

- Funding decisions based on your customers’ creditworthiness

- Receive cash within 24 hours of approval

- Back office and collections support

- Set loan amount with strict criteria for increasing the limit

- Often requires additional collateral

- Funding decisions based on a stringent review of your creditworthiness

- Long review periods before funding is approved

- No back office support

Line of Credit (Bank loans, etc.)

- Set loan amount with strict criteria for increasing the limit

- Often requires additional collateral

- Funding decisions based on a stringent review of your creditworthiness

- Long review periods before funding is approved

- No back office support

FINDING THE BEST FACTORING COMPANIES FOR CONSTRUCTION

EZ Invoice Factoring works with a variety of companies in the construction industry, and our construction supply factors are experts in the field. We offer the highest advance rates in the industry, without minimums or long-term contracts. The increased cash flow will help you pay your bills, hire new labor, and expand your business.

If your customers are creditworthy, your invoices are current and you have established payment terms, EZ Invoice Factoring’s construction supply factoring program may be right for you. Invoice factoring for construction suppliers turns open invoices into instant cash to keep your company running smoothly.