About Invoice Factoring

Fast invoice factoring and funding services get you the cash when you need it most.

Positive cash flow is essential to running a successful company. Without a steady stream of cash, it is impossible to pay bills, manage payroll, or build the resources to expand. Unfortunately, available cash dries up quickly when your bills are due before your receivables are paid.

As this gap grows it can affect your ability to attract new business, as well as your creditworthiness. This is a dangerous equation for any business, leading to difficulty obtaining financing which then perpetuates the cycle.

What is Invoice Factoring?

Invoice factoring is a financial transaction where a business sells its accounts receivable to a third party at a discount. The factoring cost and overall invoice factoring cost can vary based on factors such as customer creditworthiness, invoice volume, and specific terms of the factoring agreement.

Both invoice factoring and invoice financing allow businesses to access cash for unpaid invoices and address cash flow issues. However, they differ in key aspects such as control over invoice collection and underwriting criteria. Invoice financing retains control over the collection of invoices and typically involves no credit checks, making it a more accessible and flexible solution for businesses needing quick cash flow solutions.

How Does Invoice Factoring Work?

Invoice factoring works by allowing businesses to sell their invoices to a factoring company at a discount. The factoring company then advances a percentage of the invoice value to the business, usually around 70-90%. The factoring company takes over the collection process and, once the invoice is paid, remits the remaining balance to the business, minus a fee.

Invoice factoring companies play a crucial role in this process by evaluating the creditworthiness of the business’s customers and assessing potential hidden fees. They use customer credit checks and alternative methods to assess business performance for financing.

Understanding how invoice factoring works involves knowing the detailed steps: selling invoices, receiving advances, and the subsequent collection and fee processes. This provides a comprehensive understanding of how this financial tool operates.

In contrast, invoice financing allows businesses to borrow against their unpaid invoices to obtain cash advances while retaining control over the collection of invoices. This typically involves no credit checks, making it a more accessible and flexible solution for businesses needing quick cash flow solutions.

What is Invoice Factoring?

Invoice factoring is a financial tool that allows businesses to access cash quickly without taking on debt. It involves selling unpaid invoices to a third-party factoring company at a discounted rate. This process enables businesses to unlock the cash value of their outstanding invoices, improving their cash flow and financial stability. Invoice factoring is commonly used by businesses that have a high volume of invoices and a strong credit history.

How Does Invoice Factoring Work?

The invoice factoring process typically involves the following steps:

- A business sends an invoice to its customer, requesting payment for goods or services provided.

- The business sells the outstanding invoice to a factoring company at a discounted rate.

- The factoring company advances a percentage of the invoice value to the business, usually within 24 hours.

- The factoring company assumes responsibility for collecting payment from the customer.

- Once the customer pays the invoice, the factoring company sends the remaining balance to the business, minus a factoring fee.

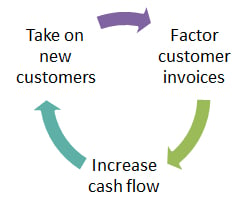

Grow Your Company with Fast Invoice Factoring Solutions for Improved Cash Flow

Invoice factoring can help your company survive and even thrive. Unlike conventional business loans, factoring uses your existing invoices to generate cash. A factor will qualify your customers for a credit line, then advance you cash against invoices for products or services provided. Once your customers pay, the invoice factor will release the remainder of the invoice value to you, less their fees.

With fast invoice factoring, your company can benefit from same-day funding. Initial factoring funding takes only 3-5 days. After that, invoice factoring cash is available within 24 hours of invoice submission. Linking a business bank account can lead to faster approval processes and funding availability. If you’re looking for fast cash and don’t have weeks, or months, to wait for bank loan approval, then invoice factoring is right for your company.

Recourse factoring has financial implications for businesses, as it requires the business to repay the factoring company if their customers fail to pay their invoices. This contrasts with non-recourse factoring, which carries lower risk but may come with higher fees.

Benefits of Invoice Factoring

Invoice factoring offers several benefits to businesses, including:

- Improved cash flow: By selling outstanding invoices, businesses can access cash quickly and improve their financial stability.

- Reduced risk: Factoring companies assume the risk of non-payment by customers, reducing the financial burden on businesses.

- Increased working capital: Invoice factoring enables businesses to access working capital without taking on debt, allowing them to invest in growth and expansion.

- Simplified accounting: Factoring companies handle the collection of payments, reducing the administrative burden on businesses.

Cash Flow Management with Invoice Factoring

Invoice factoring can be an effective tool for managing cash flow, especially for businesses with a high volume of invoices. By selling outstanding invoices, businesses can access cash quickly and improve their financial stability. Additionally, factoring companies can provide valuable insights and advice on cash flow management, helping businesses to optimize their financial performance.

Ready to Get Started?

Fill out the form below and one of our factoring experts will help you on your way!

In addition to fast funding, invoice factoring provides additional benefits:

Unlimited funding potential. Bank loans are for a set amount and it is typically very difficult to extend the credit line further without additional collateral. Factoring, however, is only limited by the amount of business you do. Greater cash flow means more business, which in turn means more invoices to factor.

Qualify for funding despite poor credit. The factor will consider your customer’s creditworthiness as the basis for funding decisions, and will not require collateral from you. As long as you are free of tax and legal issues, it is easy to get started.

Receive cash when you need it. Invoice factoring is a flexible process. Once your customers are approved, you can submit invoices as often as you need and receive cash advances within 24 hours. Rather than wait for a check to clear, funds are wired or sent via ACH directly to your bank account.

Gain access to back-office support. Many factors offer back-office support, giving you more time to focus on expanding your business and delivering top quality to your customers.

Start Factoring and Stop Waiting

Invoice factoring is an ideal funding solution if you have cash tied up in unpaid receivables. EZ Invoice Factoring partners with experienced factors that work with companies worldwide and will set up a factoring program that works for you. If you have additional questions about invoice factoring, check out our invoice factoring FAQ’s.